For many businesses, reconciling accounts has traditionally been one of the most time-consuming and error-prone tasks. Manually entering transactions, downloading statements and matching payments to invoices all take up valuable hours that could be spent on higher-priority work.

Fortunately, modern accounting software has transformed this process through bank feeds.

In simple terms, a bank feed is a secure digital connection between your business bank account and your accounting system. Instead of manually importing bank statements, transactions flow automatically into your software, ready to be reconciled against invoices, bills and expenses. This seamless integration not only saves time but also provides a more accurate and up-to-date picture of your finances.

In this article, we’ll explore what bank feeds are, how they work and why they’ve become such an essential tool for modern businesses. We’ll also look at the specific benefits that accounting software bank feeds bring to wholesalers, distributors and other organisations that want to manage their finances more efficiently.

What is a bank feed?

A bank feed is essentially a digital pipeline that links your bank account with your accounting software. When connected, it automatically imports all the transactions from your bank account into your accounting system.

This connection means you don’t need to manually download and upload statements or spend hours inputting each transaction line-by-line. Instead, every payment received, purchase made or bank fee charged appears directly within your software, often within 24 hours of it clearing in your account.

For example, if a customer pays an invoice via bank transfer, that payment will appear automatically in your accounting system through the bank feed. You can then match it against the invoice with a single click. The same applies to supplier payments, standing orders and even card transactions.

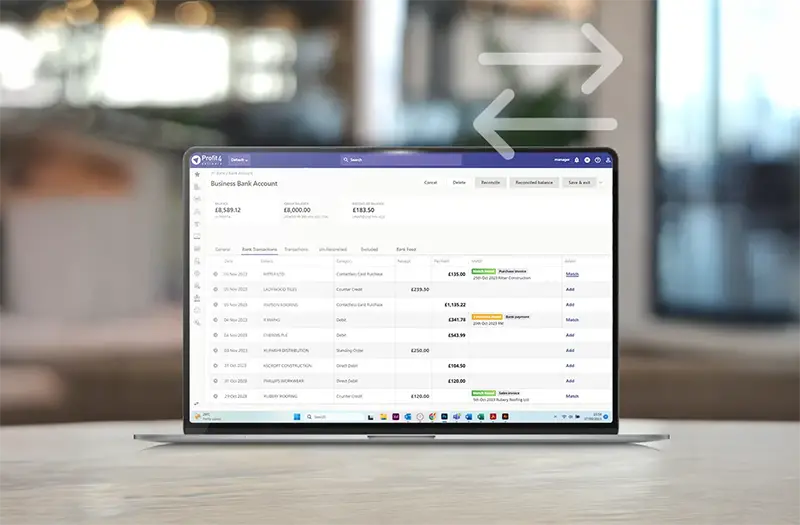

ERP software like Profit4, will then automatically update matched invoices to “paid” and the appropriate postings will be made in your sales, purchase and nominal ledgers. Speeding up the reconciliation process considerably.

Most leading accounting platforms now offer bank feed functionality, often through direct partnerships with banks. In the UK, the introduction of Open Banking regulations in 2017 accelerated adoption, making secure and reliable bank feeds more widely available than ever before.

How do bank feeds work?

Bank feeds work by creating a secure connection between your accounting software and your bank. This can happen in two main ways:

- Direct bank connections – Many banks have established official integrations with accounting platforms. These are typically powered by Open Banking APIs, which ensure that data is transferred securely and in compliance with financial regulations.

- Third-party connections – In some cases, providers use third-party aggregators to connect banks with accounting software. These connections are also secure but may require reauthorisation more frequently.

Once set up, the feed will automatically pull through transaction data from your account on a daily basis. Depending on your software, you may also be able to refresh it manually if you want to see more up-to-date information.

The transactions are then displayed in your accounting system, ready for reconciliation. Some platforms can even use rules and machine learning and AI-driven matching to suggest which invoice or bill a payment relates to, further reducing manual effort.

Why are bank feeds important?

At its core, a bank feed bridges the gap between your financial records and your actual bank account. Without it, businesses face a lag between when transactions happen and when they are recorded in their accounting system. This delay can cause problems such as inaccurate cash flow forecasts, missed payments and errors during reconciliation.

With a bank feed in place, your financial data becomes more timely and reliable. You gain visibility into your cash position at any given moment, which is crucial for making informed decisions – whether it’s about investing in stock, negotiating supplier terms or paying staff.

For wholesalers and other businesses with high transaction volumes, this real-time insight is particularly valuable. Instead of dealing with a backlog of manual entries, you can keep your records accurate and up to date with minimal effort.

Key benefits of accounting software bank feeds

Bank feeds offer a wide range of benefits, from reducing admin to improving decision-making. Let’s look at some of the most important advantages in more detail.

Time savings

One of the biggest advantages of bank feeds is the sheer amount of time they save. Reconciling accounts is no longer a weekly or monthly chore, it becomes a daily process that takes minutes rather than hours. By automating the flow of transactions, staff are freed up to focus on more valuable activities, whether that’s chasing new opportunities or managing customer relationships.

Improved accuracy

Manual data entry inevitably carries the risk of human error. A missed decimal point, a transposed digit or an overlooked transaction can all create discrepancies in your accounts. Bank feeds remove this risk by pulling data directly from the bank, guaranteeing every transaction is recorded exactly as it occurred. This accuracy makes reconciliation smoother and gives you confidence in your financial reports.

Real-time financial insight

With bank feeds, your accounts reflect reality much more closely. Instead of working with outdated records, you can see your current cash position at a glance. This real-time insight is particularly useful for managing cash flow – one of the most common challenges for wholesalers and growing businesses. Having a clear view of money coming in and going out helps you make better decisions about spending, investing or holding back funds.

Easier fraud detection and security

Another important benefit of bank feeds is that they make it easier to spot unusual or fraudulent activity. Because transactions are pulled into your system daily, discrepancies stand out much sooner. If there’s a payment you don’t recognise or an unexpected withdrawal, you can act quickly rather than discovering the issue weeks later when reconciling statements manually.

This speed of detection can prevent significant losses and give business owners peace of mind. Combined with the security frameworks of Open Banking, bank feeds are designed to ensure that sensitive financial data is transferred safely between your bank and your accounting software.

Scalability for growing businesses

As businesses grow, so too does the complexity of their financial operations. A wholesaler handling hundreds of transactions a month may find manual reconciliation manageable, but once that grows into thousands, the process quickly becomes overwhelming.

Bank feeds provide the scalability needed to handle this growth without a corresponding increase in admin workload. By automating transaction entry, they allow finance teams to keep pace with increased volumes while still maintaining accuracy and control.

This scalability is particularly valuable for wholesalers, distributors and other companies in fast-moving industries where margins can be tight and efficiency is key.

Seamless integration with wider workflows

Bank feeds also play a key role in connecting financial management with other areas of the business. When integrated with ERP software, bank feeds don’t just update your accounts, they become part of a broader workflow that links sales, stock, purchasing and finance.

This integration allows you to reconcile customer payments against invoices automatically, track supplier costs more effectively and guarantee that financial reports are always aligned with operational data. Instead of existing as a separate process, reconciliation becomes part of a streamlined end-to-end workflow.

How Profit4 makes bank feeds even more powerful

While many accounting platforms now offer bank feeds, their real value comes when integrated with an ERP system designed for wholesalers. That’s where Profit4 comes in.

Profit4 connects your bank feeds with your entire business operation. Instead of just automating reconciliation, it brings together your financial data, stock management, order processing and purchasing workflows in one central platform.

Here’s what that means in practice:

- Automatic matching of transactions to invoices and sales orders – Customer payments can be reconciled instantly, reducing debtor days and improving cash flow.

- Supplier payments linked to purchasing – Track costs against specific purchase orders and gain a clear picture of supplier relationships.

- Real-time financial visibility – With bank feeds feeding directly into Profit4, your cash flow reports are always accurate and up to date.

- Scalability as you grow – Whether you’re handling hundreds or thousands of monthly transactions, Profit4 ensures your workflows remain efficient and error-free.

By combining the efficiency of bank feeds with the wider capabilities of ERP, Profit4 gives wholesalers the tools to manage finances proactively rather than reactively.

Why bank feeds are no longer optional

Bank feeds have gone from being a ‘nice-to-have’ feature to an essential part of modern business finance. They save time, reduce errors, and give businesses the real-time visibility they need to make informed decisions.

For wholesalers distributors and other businesses that process high volumes of transactions, the benefits are even more pronounced. Bank feeds aren’t just about making life easier – they’re about enabling sustainable growth.

See how Profit4 can help

Integrating bank feeds with the right software is the key to unlocking their full potential. With Profit4, you don’t just automate reconciliation – you connect your financial data to every aspect of your business, from stock and purchasing to sales and reporting.

Watch our three-minute demo to discover how Profit4 can streamline your workflows and give you greater control over your finances.